Search

What Do You Need Today?

- At Home

-

- Acorn Stairlifts - Free DVD Info Pack

- ADT Companion Services - One Button Summons Help

- Contour Adjustable Beds - Win A Free Bed

- Crochet World Magazine - Free Issue

- Dish TV - $19.99 Per Month for 1 Year

- Dream Products - Flower Pot Tomatoes

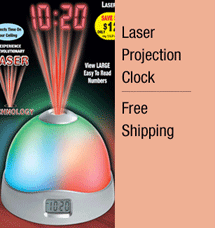

- Dream Products - Laser Clock

- Dream Products - Riddex® Sonic Plus

- Good Old Days Magazine - Free Issue

- Life Alert - I Live Alone, But I'm Never Alone

- Medical Alert – This One Button Can Summon Help

- Newsmax - Free Emergency Radio

- Philips Lifeline - After a Fall, Every Second Counts

- Premier Care in Bathing - Free Brochure

- SafeStep Walk-in Tubs - Safety Never Felt So Good

- Sears – Central Cooling & Heating Systems

- Sears - Premium Vinyl Siding

- Sleep Number Bed - $50 Savings Card

- Solution ComfortSeat - World's Greatest Toilet Seat

- SunSetter Awnings - Free Awning Idea Kit & DVD

- Wedge Radio - Free Shipping & Free Remote

- Auto Insurance

- Bathroom

- Beauty

-

- Bosom Buddy – For Those Who’ve Had Breast Surgery

- Dream Products - High Waist Girdle Panties

- Dream Products - Instant Slimming Briefs

- Dream Products - Instant Slimming Top

- Dream Products - Sta Cool Comfort Bra

- Dream Products - Yes Bra

- Holsted Jewelers - Free Ring & Surprise Gift

- Paula Young - Free Wig Catalog

- Beds

- Catheters

- Cell Phones

- Clothing

-

- Bosom Buddy – For Those Who’ve Had Breast Surgery

- Bradford - Bereavement Embrace Ring

- Bradford - I Love Lucy Sneakers

- Bradford - Lena Fleece Jacket

- Bradford - Sunflower Sneakers

- Dream Products - 24 Hour Health Slippers

- Dream Products - Circulation Stockings

- Dream Products - Copper Bracelet

- Dream Products - Diabetic Socks

- Dream Products - Double Security Zip-Around Fan Wallet

- Dream Products - High Waist Girdle Panties

- Dream Products - Indoor/Outdoor Comfort Moccasins

- Dream Products - Instant Slimming Briefs

- Dream Products - Instant Slimming Top

- Dream Products - Magnetic Knee Therapy

- Dream Products - Memory Cushioned Super Scuffs

- Dream Products - Moccasin Boots

- Dream Products - Silver Therapy Compression Socks

- Dream Products - Slipper Socks

- Dream Products - Snap Front Comfort Bra

- Dream Products - Sta Cool Comfort Bra

- Dream Products - Thermal Knee Warmers

- Dream Products - Toe Alignment Slippers

- Dream Products - Yes Bra

- Dream Products - Zip Up Security I.D. Credit Card Case

- Holsted Jewelers - Free Ring & Surprise Gift

- NewsMax - Free Heart Rate Monitor Watch

- Paula Young - Free Wig Catalog

- Coins

- Collectibles

-

- American Historic Society - 50 State Quarters Free

- Bradford - Bereavement Embrace Ring

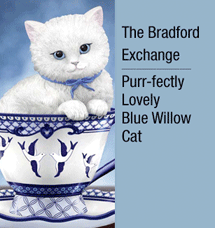

- Bradford - Blue Willow Cat

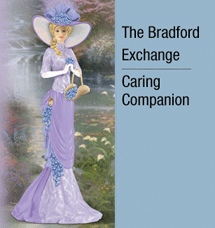

- Bradford - Caring Companion Figurine

- Bradford - Chihuahua Teacup

- Bradford - Coke Timeless Pause

- Bradford - Corvette Cuckoo Clock

- Bradford - Flying Scotsman Train Cuckoo

- Bradford - Garden of Prayer Bowl

- Bradford - Granddaughter, You're My Little Dear Music Box

- Bradford - Grandma's Pearls of Wisdom

- Bradford - I Love Lucy Cuckoo Clock

- Bradford - I Love Lucy Sneakers

- Bradford - John Deere Cuckoo Clock

- Bradford - John Wayne Cuckoo Clock

- Bradford - John Wayne Legend Print

- Bradford - John Wayne Pistol

- Bradford - Kinkade Canvas Heart

- Bradford - Kinkade Loving Remembrance Memorial Candleholder

- Bradford - Lena Liu Canvas Print

- Bradford - Lena Liu Fleece Jacket

- Bradford - My Granddaughter, My Princess

- Bradford - Mystical Mystery Cat Figurine

- Bradford - Paws'itively Posh Pup

- Bradford - Precious Moments

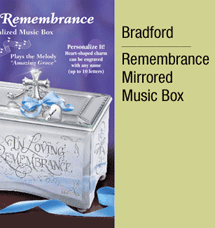

- Bradford - Remembrance Mirrored Music Box

- Bradford - Seasonal Kitten Art Welcome Signs

- Bradford - Shih-Tzu Teacup

- Bradford - Songbirds of the Seasons

- Bradford - Sunflower Sneakers

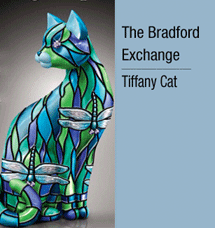

- Bradford - Tiffany Cat

- Bradford - Tiffany Elephant

- Littleton Coin - D.C. & U.S. Territories Series

- Littleton Coin - Own Three Scarce Collector Classics

- Mystic Stamp - 100 Mint U.S. Stamps Only $5

- Mystic Stamp - Free U.S. Stamp Catalog

- Mystic Stamp - U.S. Stamps of the 50 States Only $2

- Contests

- Diabetes

- Emergency Alert

- Gardening

- Health & Herbal Supplements

- Hearing Aids

- Heart Health

- Home Improvements

-

- Premier Care in Bathing - Free Brochure

- SafeStep Walk-in Tubs - Safety Never Felt So Good

- ScaleRID - Get Rid of Hard Water Problems

- Sears – Central Cooling & Heating Systems

- Sears - Premium Vinyl Siding

- Solution ComfortSeat - World's Greatest Toilet Seat

- SunSetter Awnings - Free Awning Idea Kit & DVD

- Home Security Services

- Impotence

- Incontinence

- Jewelry

- Magazines

- Meals

- Medical Supplies

-

- Beyond Medical – Diabetic V.I.P. Program

- Beyond Medical – Unlimited Portable Oxygen

- Bonro – Erectile Dysfunction

- Diabetic Support Program – Knee, Wrist & Back Braces

- Inogen One – Attention Oxygen Therapy Users

- Liberator Medical - Free Catheter Samples

- Open-Aire - Unlimited Portable Oxygen

- OxyGo2 - Travel Oxygen

- Medicare Supplement Insurance

- Membership Discounts

- Mobility Aids

-

- Acorn Stairlifts - Free DVD Info Pack

- Contour Adjustable Beds - Win A Free Bed

- Hoveround - Free Information Kit

- Open-Aire - Power Wheelchair at Little or No Out-of-Pocket Cost

- Premier Care in Bathing - Free Brochure

- SafeStep Walk-in Tubs - Safety Never Felt So Good

- Solution ComfortSeat - World's Greatest Toilet Seat

- Oxygen

- Pain Relief

-

- Beyond Medical – Diabetic V.I.P. Program

- Beyond Medical – Ease Your Aching Joints

- Contour Adjustable Beds - Win A Free Bed

- Diabetic Support Program - Knee, Wrist & Back Braces

- Dream Products - 24 Hour Health Slippers

- Dream Products - Circulation Stockings

- Dream Products - Comfort Moccasins

- Dream Products - Copper Bracelet

- Dream Products - Diabetic Socks

- Dream Products - Magnetic Knee Therapy

- Dream Products - Memory Cushioned Super Scuffs

- Dream Products - Moccasin Boots

- Dream Products - Silver Therapy Compression Socks

- Dream Products - Thermal Knee Warmers

- Dream Products - Toe Alignment Pads

- Dream Products - Toe Alignment Slippers

- Nopalea – Inflammation Relief – Free 32-oz. Bottle

- Sleep Number Bed - $50 Savings Card

- Solution ComfortSeat - World's Greatest Toilet Seat

- Preplanning

- Prescriptions

- Radios

- Reverse Mortgages

- Shopping

- Stamps

- Sunrooms & Patios

- Telephone Services

- Television Services

- Toilet Seats

- Walk-in Bathtubs

- Wigs & Hair Pieces

- Wheelchairs & Scooters

Where do you want to travel?

- Alaska Cruise & West Coast Train Tour

- Autumn Leaves Tour

- Best of Ireland Tour

- Best of England & Scotland

- Canadian Rockies Tour with Rail

- Hawaii Cruise & Tour

- Northeast Cruise & Tour

- Southwest Tour & Balloon Fiesta

- National Parks Tours

June 2012

ADVICE & MORE

Beware the Danger of Carrying Your Medicare Card

A thief who manages to lay hold of your wallet stands to score a much bigger hit if he or she also gets your Social Security number (SSN). That’s why the Social Security Administration advises…

HEALTH

More Problems with Statin Medications – Now Also Linked to Increased Risk of Diabetes

The Mayo report said very rarely do statins cause life-threatening muscle damage. But they can cause severe muscle pain, liver damage, and kidney failure. Although liver problems are relatively rare, the Mayo report says…

MONEY

Social Security Goes Green: No More Paper Checks!

In 2010 alone, more than 540,000 Social Security paper checks were lost or stolen and had to be replaced, at great inconvenience and distress to the recipients. Under the new paperless system…

NEWS

The Budget Battles Begin: Seniors Firmly in the Crossfire

Even with the election in the crossfire, the fiscal 2013 budget fight is really about governing after the November elections. Each side is counting on the fall elections to retain or take control of the White House and to gain or retain control of Congress, in order to…

REFLECTIONS

The Old Ways Often Cloud Our Judgment

My old telephone was a massive black instrument, with a large ten-hole rotary disk for dialing numbers. Yes, the handset cord had me tethered to the phone and it always got tangled up, but I felt a sense of security as I was using that stationary phone. That's probably because…

Check out our VOICE Table of Contents

Get unlimited access to VOICE magazine, special SAVINGS from our sponsors, YUM recipes and cooking advice, RESOURCES and more. Plus get a personal Lucky Number that gets you into the Circle and allows you to enter go60 $1,000.00 drawings whenever you visit. It's free. No personal information is required (except your email address). You may terminate your membership at any time (but why would you!).