Washington Watch

Important Tips to Save Even More on Medicare Charges to You

Last fall, Medicare officials announced that patients whose doctors expect them to stay in the hospital through two midnights or longer should be admitted as in-patients, not given observation status. This was a rules change needed to deal with an increasing number of seniors who were going into hospitals, but instead of being admitted, were placed under “observation status.”

Last fall, Medicare officials announced that patients whose doctors expect them to stay in the hospital through two midnights or longer should be admitted as in-patients, not given observation status. This was a rules change needed to deal with an increasing number of seniors who were going into hospitals, but instead of being admitted, were placed under “observation status.”

These patients were treated like all the other admitted hospital patients, but because this status is considered outpatient care – later, when they were released from the hospital, they could not qualify for nursing home coverage, even if they were in the hospital for three days. They also faced higher out-of-pocket costs, including higher copayments and charges for drugs that are not covered for outpatient stays.

What made things worse is that many seniors in a regular hospital room didn’t know they’re in observation care because hospitals aren’t required to tell them. They only found out later when they were denied care or services.

As the federal government continues to deal with the “observation” problem, the number of Medicare observation patients has shot up 88 percent over the past six years, to 1.8 million in 2012, according to the Medicare Payment Advisory Commission, an independent agency.

But then Medicare announced a moratorium on penalizing hospitals that violate the rules. Congress has extended the moratorium through March 2015.

Now, the so-called “two midnight” rule has become even more controversial than the old system.

Making matters worse, the federal government may be overpaying hospitals an estimated $5 billion as a result of the 18-month moratorium on enforcing this controversial rule that tells hospitals when patients should be admitted, an independent Medicare auditing company told a congressional panel recently. The American Hospital Association claims that the $5 billion figure is inaccurate.

So faced with withering criticism, Medicare officials are asking Congress for ideas on how to design a new payment system for treating Medicare patients who need only a day or so in the hospital. The issue is an administrative nightmare for Medicare with billions of Medicare dollars at stake flowing to thousands of hospitals and doctors.

Don’t be surprised if Medicare completely trashes the two midnight rule for short hospital stays. At least that’s the take-away from testimony at a recent Congressional hearing by Medicare Deputy Administrator Sean Cavanaugh.

The newly-appointed deputy administrator at the Centers for Medicare & Medicaid Services, defended the two-midnight rule at the first-ever Congressional hearing on this subject, telling the House Health Subcommittee that the agency intended to balance several principles: the need for clear admissions criteria that “are consistent with sound clinical practice, reflect the beneficiaries’ medical needs, respect a physician’s judgment, and are consistent with the efficient delivery of care to protect” Medicare’s fiscal health.

Cavanaugh said that the agency is seeking public input on how to define short hospital stays and how to design a more appropriate payment. Among the new ideas being floated are setting new per-day rates or capping inpatient costs for some services.

The real problem is that many Medicare patients could technically qualify for inpatient or outpatient care, depending on how the admitting doctor interprets what he sees when you are admitted. It gets complicated because hospitals stand to collect three times more money for inpatient care than for outpatient observation.

Take a typical patient, to understand the dollars involved. A person shows up at an emergency room complaining of chest pains. One hospital could admit the patient for inpatient care, while another could hold him in the hospital for outpatient observation and testing. While the services and lab tests would be similar if not identical, inpatient payments for short-stay inpatient care average $5,142, while outpatient observation payments average $1,741.

No surprise then, that lawmakers heard testimony where some hospitals were admitting short-stay patients way more frequently than other hospitals. HHS Regional Inspector General Jodi Nudelman told lawmakers that some hospitals attribute 70% of their entire inpatient base to short-stay admissions, while others admit short-stay patients less than 10% of the time.

Amy Deutschendorf, senior director of clinical resource management at the Johns Hopkins Medical System in Baltimore, told the committee that instead of reducing the number of observation patients as Medicare officials hoped, the rule has had the opposite effect. “Since Oct. 1, 2013, we have seen a three-fold increase in the number of patients our physicians cautiously predicted would only stay only one midnight, and thus began as outpatients, but later had to admit for longer stays, demonstrating the complexity of anticipating length of stay based on a patient’s initial presenting symptoms,” she said.

And if patients improve after receiving extensive treatment for less than two midnights, she said they are considered observation patients, and hospitals are penalized for doing a good job by earning a lower payment from Medicare than for admitted patients.

“We call it the Cinderella rule,” Deutschendorf told Kaiser Health News said after the hearing. “It’s confusing to hospitals as well as patients, who haven’t been informed that their Medicare Part A hospital benefit doesn’t cover stays less than two-midnights.”

The two-midnight rule was supposed to cut through the uncertainty by declaring that an admitting physician needs to have documented reasons for believing, at the time, that a patient would need two nights in the hospital in order to justify full inpatient rates. But doctors told lawmakers that these justifications were arbitrary and had what one labeled “no basis in sound clinical judgment.”

Rep. Bill Pascrell, D-N.J., asked Cavanaugh if anything can be done to remove Medicare’s three-day hospitalization requirement for nursing home coverage. Cavanaugh said the Affordable Care Act allows the agency to waive it, which it has done in some experimental payment programs. “We will evaluate the results closely,” Cavanaugh said.

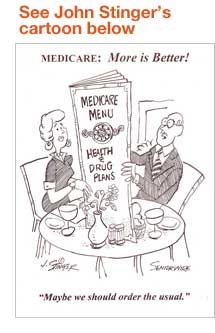

Too Many Medical Plan Options?

Do you feel overwhelmed by the number of choices you have when it comes time to choose a Medicare health or prescription drug plan? If that’s the case, you are not alone and according to a new study, a large number of seniors stick with the same plan – even if it’s not the best one for them. In some places around the country, beneficiaries can select from an average of 18 health plans and 31 prescription drug plans. In south Florida, beneficiaries have 88 plan choices altogether.

But according to a report by the Kaiser Family Foundation, many seniors didn’t want to switch plans because the process was so frustrating. That can cost them money because companies regularly change prices and benefits annually. Barry Schwartz, a psychology professor at Swarthmore College and author of the book Paradox of Choice, told reporters at a briefing about the report, that older people tend to make choices that are “good enough,” while younger people often search for the “perfect” choice.

But Judith Stein, executive director of the Center for Medicare Advocacy, warns that what is good enough at one point isn’t good enough later as medical conditions change. That’s because a plan may not include coverage for the hospital or doctor they want or may charge too much for the drug their doctor recommends.

Even with so many choices, the study found, that seniors gravitate to a small number of plans. Analysts point out that plans with the most market share, including those run by insurance giants Humana and UnitedHealthcare have grown the fastest in recent years.

What can seniors do to help them choose the best plan? In 2012, the federal government began rating the plans based on factors like access to doctors and customer service. The idea was to gently nudge millions of beneficiaries out of several private drug and medical plans that had performed poorly over the previous three years.

But some people are reluctant to change. For some, plan ratings are not as important as price, any restrictions on drugs, such as special authorization needed or requirements to try a substitute first, or in the case of a medical plan, whether their doctors can participate.

In recent years, the best-rated health plans, those with five stars, have increased enrollment at the slowest pace, the study found. Analysts suggest that price, particularly monthly premiums, are what seems to be affecting seniors’ choices. One reason why they have not moved to the best-rated plans is because there are so few of them. For 2014, the Centers for Medicare and Medicaid Services awarded five-star ratings to 14 health plans and 5 prescription drug plans.

About 75 percent of Medicare’s 54 million beneficiaries are enrolled in a private health or drug plan. The rest get traditional Medicare. Joshua Raskin, senior analyst for investment firm Barclays Capital told Kaiser Health News that because health insurers know seniors are most likely to pick plans based on price, they are hesitant to charge a monthly premium if they have not had one, or to implement a major rate hike.

Medicare Wasting Dollars on Prescriptions for Low-income Seniors

Medicare is spending billions of dollars more than it needs to on prescription drugs for low-income seniors and disabled beneficiaries, a new study finds. In 2013, an estimated 10 million people who participate in the Medicare prescription drug program, known as Part D, received government subsidies to help pay for that coverage. These folks account for roughly three-fourths of the program’s cost. Most of these low-income enrollees are placed in a plan randomly that costs less than the average for the region where the person lives.

But even though they are lower-cost plans, a University of Pittsburgh study finds they often end up costing the federal government and the beneficiaries more. If Medicare were to assign these folks to a drug plan based on the actual drugs they took, Medicare could save those patients both hassle and money and could potentially save the government billions of dollars.

The study, which appears in the June issue of the policy journal Health Affairs, found that taking five percent of Medicare’s drug claims from 2008 and 2009, if Medicare had matched beneficiaries to drug plans using “intelligent reassignment” instead of random choice, the federal government would have saved $5 billion in 2009. The reason is because the government picks up the copayment costs for many low-income beneficiaries.

At the same time, beneficiaries who are assigned to plans that don’t cover the drugs they take have to pay their out-of-pocket expenses, or have to go back to their doctors to get authorization for specific drugs or specific quantities of medications.

When the law was first created, lawmakers specifically chose to make sure beneficiaries got random assignments to ensure that no one plan got a disproportionate number of very sick beneficiaries. Medicare would have to change the law in order to change the way Medicare assigns low-income beneficiaries to Plan D plans.

[Contributing to this story: Kaiser Health News; Modern Healthcare]

Alan Schlein is the author of "Find It Online," and an internet consultant. He can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.

John Stinger Cartoon