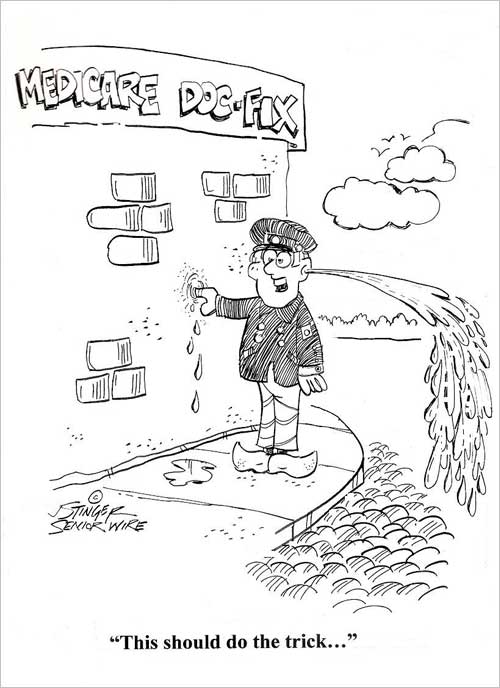

Yet Another Medicare ‘Doc Fix’

Yet Another Medicare ‘Doc Fix’

House and Senate lawmakers came together at the last minute, again, with a one-year temporary fix to a pricey formula that determines how much the government pays doctors who treat Medicare patients. If the measure had not passed, Medicare doctors would have taken a 24 percent cut starting April 1 in their government reimbursement fees for servicing Medicare patients.

The so-called “doc fix” has been a problem for lawmakers since 1997, when the Sustainable Growth Rate went into effect as part of that year’s budget. This is the 17th time Congress has stepped in with a temporary fix to the poorly-designed Medicare fee formula. Once again, the temporary fix was needed when lawmakers were unable to reach a longer-term solution.

In order to get a reluctant Republican House to go along, GOP leaders worked with their Democratic counterparts to orchestrate a ploy. As members came back to the floor when the House came into session, they discovered that the bill had already passed. No one voted yes or no, but almost everyone was surprised. The maneuvering came after a long delay amid Republican opposition that threatened to kill the bill. It was a slick move for a GOP leadership group that has been obsessed with operating strictly under the rules. But House leaders saw no other option, as they would have needed upwards of 270 votes to pass the bill under the fast-track mechanism they set up.

A bipartisan consensus seems to have emerged on how to replace the temporary fix with a long term repair –yes this issue will be back again next year unless it gets fixed long term – but deep partisan divisions exist over how to pay for it. Lawmakers want to redesign the payment formula that would give doctors 0.5 percent annual fee increases and implement changes aimed at giving doctors incentives to provide less costly care. But there is no agreement on how to pay for the approximately $140 billion cost of scrapping the old formula.

The bill which passed both the House and the Senate, included about $5 billion for a variety of other expiring health care provision, including higher Medicare payments to rural hospitals and for ambulance rides in rural areas.

The bill also contains a provision benefiting, among others, Amgen Inc., which produces an oral drug for kidney dialysis patients. It would extend through 2024 a controversial provision to allow payments for Sensipar, which is made by Amgen, to be made on top of other payments to treat Medicare patients with kidney disease. It also eases cuts to dialysis providers who have battled with drug companies over the issue.

“We are going to put off until tomorrow what we should be doing today,” said Sen. Tom Coburn, R-Okla., a critic of the bill. “It’s a sham.... It’s nothing but gimmicks.” The legislation also creates two new mental health grant programs, including $1.1 billion over four years for improvements to community health centers in eight states and $60 million over four years for outpatient treatment for people with serious mental illness. Most important, it solves the fee issue until next March, 2015.

Senate Finance Chairman Ron Wyden, D-Ore., tried, unsuccessfully, to get a permanent fix, but found little support for using unspent war funds from operations in Afghanistan to pay for the measure. But Republicans are demanding savings from President Barack Obama’s health care law.

"If you just keep going with these temporary solutions, you waste time, you waste money, you threaten the access for seniors to their doctors," Wyden said. "And the reality is, the patches, as they are called, they're not free either. You still have to come up with the money."

Medicare Advantage Rules Changes:

Last fall, United Healthcare decision to drop thousands of doctors from its Medicare Advantage plans in at least 10 states. That case is still working its way through the courts. But now, federal officials are considering new Medicare Advantage rules to help protect seniors when insurers make significant reductions to their networks of doctors and other health care providers.

The federal government made this announcement as part of a 148-page rules proposal for next year’s Medicare Advantage plans released recently by the U.S. Centers for Medicare & Medicaid Services (CMS). Government officials acted because the terminations, only a few weeks before Medicare’s Dec. 7 enrollment deadline, may not have given seniors enough time to find new doctors or to choose a different plan or even rejoin traditional Medicare, which does not restrict beneficiaries to a limited network of providers.

Under the new proposal, beneficiaries would get more than 30 days advance notice of any network changes and doctors would get at least 60 days advance notice of a contract termination. Medicare officials say they need “no less than 90 days” to make sure remaining providers can continue to meet required network standards.

Nearly 16 million people – about a third of all Medicare beneficiaries – are enrolled in private Medicare Advantage plans. The plans are an alternative to traditional Medicare and the federal government reimburses insurers to care for these seniors.

Under current rules, Medicare Advantage beneficiaries are allowed to change plans if they move out of the coverage area or for other special reasons but not if they lose their doctors or hospitals. Otherwise, they can switch plans only once a year, during the annual seven-week, fall enrollment period. Since most beneficiaries are locked into their plans, CMS is also considering whether to restrict insurers’ ability to drop doctors during the plan year.

Under the new rules proposal, if an insurer expects to drop a provider during the coming year, they will need to send notice before the open enrollment season. CMS is also planning to provide a letter explaining patients’ rights in case a doctor leaves the plan during the plan year. Two Connecticut medical associations sued UnitedHealthcare to block the terminations last fall and the American Medical Association and 35 state medical association and physician advocacy groups filed legal papers in support of the doctors.

A federal court judge has since issued an injunction halting the cancellations in those Connecticut counties and a three judge Federal Appeals court panel upheld that decision temporarily, while the doctors had time to challenge the terminations.

Medicare Advantage Costs Have Slight Increase

The federal government has raised its payment estimate for Medicare Advantage plans –just a few months before a busy election season in which cuts to the program promise to be a key campaign issue for voters and politicians.

The Centers for Medicare and Medicaid Services (CMS) recently announced that 2015 payments to the plans should increase less than 1 percent overall. That compares to a drop of nearly 2 percent that the government forecast in February. Analysts expect actual funding to fall when many other variables are considered. But the drop shouldn’t be as steep as they initially forecast. This may lead to fewer changes for the plans.

The government has squeezed rates for the past few years in part to help fund the Affordable Care Act, the president’s health care legislation. Insurers that run the plans say they've had to trim benefits, drop doctors and leave markets as a result.

Medicare Advantage plans are privately run versions of the government’s Medicare program for the elderly and disabled people. The government subsidizes the coverage, and insurers generally offer dozens of different plans in every market. Many come with extras like dental and vision coverage that are not available with standard Medicare.

In the past, the government has paid insurers who run Medicare Advantage plans more per enrollee than the cost of care for people with traditional Medicare coverage. But that is being scaled back in part to help pay for Obamacare.

UnitedHealth Group Inc., the nation’s largest provider of Medicare Advantage said it’s reimbursement in 2014 was cut about 6.7 percent and CEO Stephen Hemsley told analysts earlier this year that a similar cut in 2015 would be “extraordinarily disruptive.”

Adding fuel to the political fires as the fall elections near, America’s Health Insurance Plans (AHIP), the powerful trade group has been pressuring lawmakers on Capitol Hill that Medicare Advantage consumers will be watching proposed changes to the plans. In February, AHIP and more than 40 senators from both parties called on the Obama Administration to hold Medicare Advantage rates steady.

While most Medicare Advantage plans may only see a drop of one to three percent, the government is still scaling back funding for the coverage. But it has made some adjustments to how plans are compensated for the health status of their employees, analysts suggest.

Due to intense bipartisan political pressure, the Obama administration backed down, for the second year in a row, on proposed payment cuts for insurance companies that offer Medicare Advantage. The administration, for its part, portrayed the rates as even better than the flat, year-to-year change that insurance companies sought.

"The industry asked us to use whatever means we could to keep the rates close to parity, to where they are today," Jonathan Blum, principal deputy administrator at the Centers for Medicare & Medicaid Services, told reporters. Medicare Advantage costs taxpayers about 6 percent more per beneficiary than traditional Medicare, according to the Medicare Advisory Commission. Reducing or eliminating that gap could save the program billions of dollars, proponents say.

Obama Administration Retreats on Part D Changes

The White House, after an aggressive pushback from seniors, patients, pharmaceutical companies and lawmakers from both parties, recently scrapped most of a proposed plan to limit Medicare coverage for certain classes of drugs including those used to treat depression and schizophrenia.

In January, the Centers for Medicare and Medicaid Services proposed broad changes to the Medicare Part D prescription-drug program that covers medicines for about 39 million beneficiaries. Medicare officials had said the proposal would save money and reduce the overuse of drugs. But it created political problems for the White House, with some Democrats joining Republicans in denouncing the changes, saying they would harm Medicare beneficiaries.

Since its inception in 2006, the federal government has required Medicare’s insurers to cover “all or substantially all” drugs in six treatment areas. The administration proposed in January to lift the requirement for three types of medications: immunosuppressant drugs used in transplant patients; antidepressants; and antipsychotic medicines, used to treat schizophrenia and certain related disorders.

But in a letter to lawmakers, Marilyn B. Tavenner, the administrator of the federal Centers for Medicare and Medicaid Services, said officials would not pursue the proposal. “Given the complexities of these issues and stakeholder input, we do not plan to finalize these proposals at this time,” she said.

Tavenner also decided to hold off on three other proposals. One stipulates that insurers can offer no more than two prescription drug plans to Medicare beneficiaries in the same region. Another would give patients greater access to small community pharmacies by requiring insurers to offer contracts to any retail drugstores willing to accept their terms and conditions. A third would allow the government to intervene in negotiations between insurers and pharmacies.

Tavenner said the proposals would be shelved for now. But she said the agency would "engage in further stakeholder input before advancing some or all of the changes in future years." She added that the agency planned to proceed with other proposals in its January document related to consumer protections and anti-fraud provisions that have bipartisan support. The reversal came just one day before the House was scheduled to vote on a bill that would prevent officials from carrying out any part of the proposed regulation affecting drug coverage.

[Also contributing to this article were: Kaiser Health News, Politico, New York Times, Wall Street Journal, Associated Press]

Alan Schlein runs DeadlineOnline.com, an internet training and consulting firm. He is the author of the bestselling “Find It Online” books.

John Stinger Cartoon

- Meet Our Writers

- Go60 Sponsors

- Hear Us Roar

- Sweepstakes Rules

- Sweepstakes Winners

- Contact Us

- Privacy Policy